Responsible For A Buy Driving License A1 Budget? 12 Top Notch Ways To …

페이지 정보

작성자 Inge 댓글 0건 조회 23회 작성일 25-04-19 12:55필드값 출력

본문

How to Buy Driving License A1 For Motorbikes

The A1 driving license allows you to drive motorcycles whose cylinder volume doesn't exceed the 125 cubic centimeters limit and whose power doesn't exceed 11 kilowatts. This license is accessible to people who are aged 16.

Before they can get an A1 licence, applicants must pass two tests. The first is the theory test which has 25 questions. You have to answer them in under eight minutes.

How do you get an A1 driver's license

The A1 license is a great method to begin riding motorcycles or motor scooters. This license allows drivers to drive vehicles with up to 125cc engine power. It can be obtained by passing the CBT. The A1 licence can also be used to upgrade to higher categories and eventually to the full motorcycle license.

To get a driver's licence A1 You must take an instruction course at an approved driving school or an ongoing motorcycle training center. The course will comprise a theory component that will prepare you to take the Category A1 Driver's License test. The theory test comprises 50 questions, and you have to score at minimum 41 points to pass. You can take the test at an official centre or use an online practice test to prepare.

In addition to the theoretical driving training, you will also need practical training. The actual training will differ dependent on the vehicle you want to drive. In general, it should take at least 12 90-minute sessions. This training will familiarise you with the basics of the materials as well as the additive which will include the necessary requirements for the category of vehicle.

The A1 license is a popular choice for those who just completed an CBT course. It provides an easier and safer transition to motorcycling compared to a full motorcycle license. It also has lower insurance costs for motorcycles than a CBT licence. But, it's not a licence that should be taken lightly - if you're interested in riding larger bikes, you will need to upgrade to an A2 or full motorcycle licence after having the A1 licence for 2 years.

The A1 license is a popular choice for those who just completed an CBT course. It provides an easier and safer transition to motorcycling compared to a full motorcycle license. It also has lower insurance costs for motorcycles than a CBT licence. But, it's not a licence that should be taken lightly - if you're interested in riding larger bikes, you will need to upgrade to an A2 or full motorcycle licence after having the A1 licence for 2 years.

To be eligible for an A1 driver's license, you must possess an active driving license (category B or higher) and pass the CBT test, and have the certificate of successful completion of the compulsory basic training (CBT). You may also be required to show proof of identity, address, and proof of parent/guardian residence. You will have to pay a fee of PS25. You can apply online, or by visiting your local driving authority or DVSA regional office.

What is the A1 driving license?

A1 is a type of driving license that permits you to drive a motorbike or moped. This is the initial step to getting a full motorcycle license and can be obtained at a young age of 16 years old. To obtain this license you have to pass the theory and the practical test at a certified driving school. After passing the test, an A1 license will be issued.

The A1 category allows you to drive a motorcycle with a maximum engine capacity of 150 cc and a maximum power of 11 kW. It also permits you to drive a two or Kup prawo jazdy b online three-wheeled moped. You will have to pass additional tests if you are planning to drive these kinds of vehicles. If you are an adult and want to drive a motorbike with more than 11 kW, then you need to pass a different test in order to obtain an A2 licence.

If you are an adult and already have a Category A1 license you can upgrade it to a Category A driving license after a period of two years. This can be done by taking a test at the Driving Schools Association. To qualify for this exam you must have completed a total of 12 lessons lasting 90 minutes each and pass the theory exam.

You can find the Driving Schools Association's contact details in the directory on our website. We'll be happy to help you select a course that fits your schedule. We recommend that you start with our base package. This package lets you take 12 90-minute theory classes and 1 practical lesson.

In the course you will be taught the fundamentals of road traffic and Kup prawo Jazdy A1 how to operate your vehicle. You will also learn how to determine your route and comprehend the rules. You will be guided by the driving instructor throughout the process. Although you can practice on your o ne but it is advised to follow the training closely to prepare for the practical and theory tests.

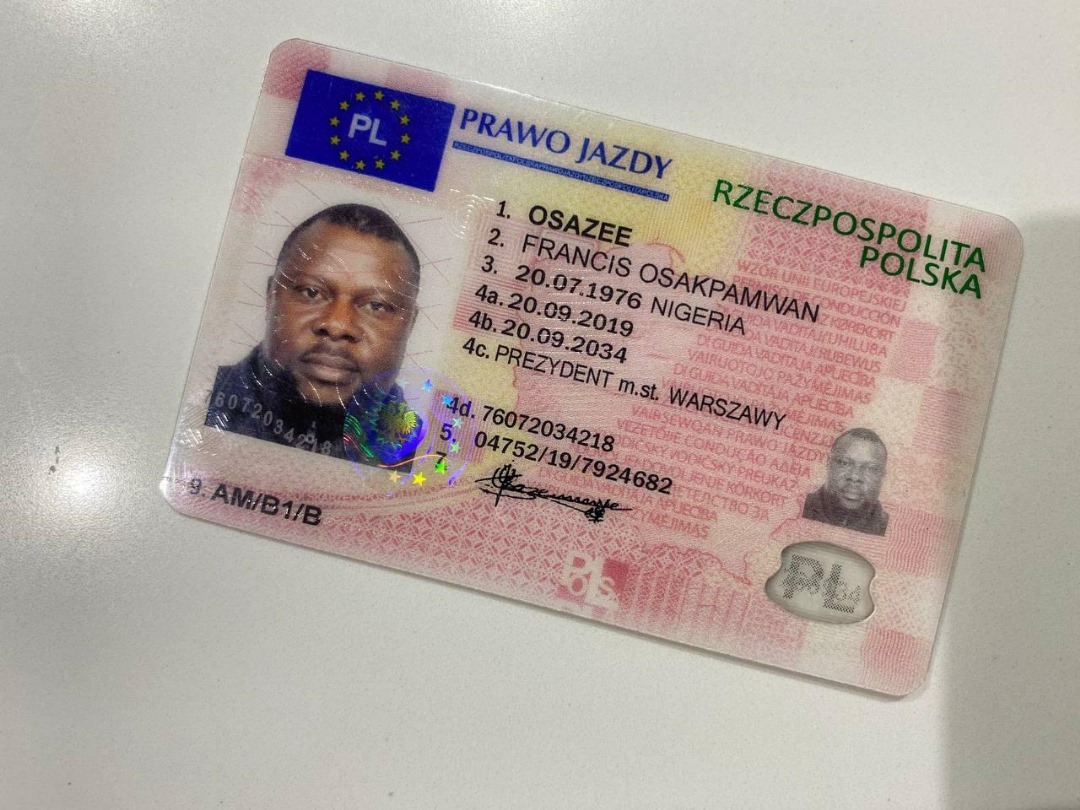

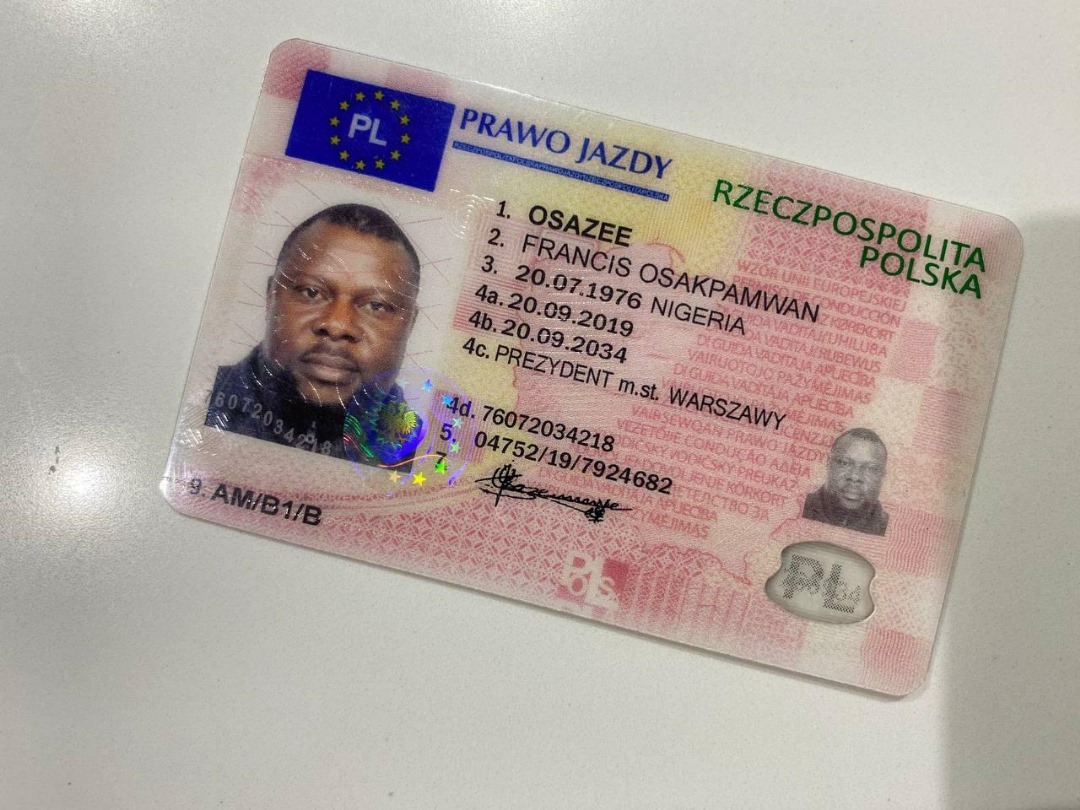

The current driving license is a laminated card that feels and looks similar to the European driving permit. It displays the name of the holder (in Latin and Cyrillic script), address, emergency contact blood group, fingerprint impression and photograph. The reverse side contains an alphabetical list of categories. Certain older licenses, such as the credit card and book style are still in use. However they are becoming increasingly rare.

What are the requirements for an A1 license?

There are a number of steps you need to follow if you want to obtain an A1 motorbike license. This includes the completion of a driving school course and passing the theory exam. After completing this training, you'll be able begin learning the fundamentals of driving and traffic rules. After that, kup prawo Jazdy a1 online you'll need to practice with your family and acquaintances until you are prepared to take the test. Once you pass the test, you will be able to begin riding your motorcycle.

The A1 category is a restricted licence that allows you to drive motorcycles or mopeds with an engine size of up to 125cc and an output of no more than 11kW. The A1 category also includes tricycles with two wheels and power/weight ratios of up to 0.1kW/kg. This licence is ideal for those looking to get experience in the world of motorbikes before taking the full A2 or a driving licence.

After two years, it's possible to upgrade your A1 license to full A, but you will need to take the theory and practical tests again. This process can be costly and frustrating, especially for riders who are young. This can be seen as a waste for people who use their bikes only to travel to work or transport passengers over short distances.

There are many ways to cut down on the cost of getting an A1 licence. One option is to go to a driving school that offers CBT training for free or at a discounted price. Another option is to finish the training with a private instructor, or an continuing ride centre.

Presently in the present, an A1 driving license is valid for 15 years. It has a numberplate as well as basic information such as the driver's name, father's name, date-of-birth, address, authorized vehicles, emergency contact information and blood group. It also includes magnet strips, but its viability is not yet tested.

How do you get an A2 driver's license?

To obtain a driver's license to obtain a driver's license, you must sign up for a driving school and successfully pass both physical and written examinations. The driving test is comprised of 50 multiple-choice questions. It's not too difficult, but it is recommended to be prepared prior to the test. You can also find online practice tests to aid you in preparing for the exam. The physical exam includes an eye-sight test, as well as a listening test. In some countries there are additional requirements such as a medical examination or proof of insurance.

To obtain a driver's license to obtain a driver's license, you must sign up for a driving school and successfully pass both physical and written examinations. The driving test is comprised of 50 multiple-choice questions. It's not too difficult, but it is recommended to be prepared prior to the test. You can also find online practice tests to aid you in preparing for the exam. The physical exam includes an eye-sight test, as well as a listening test. In some countries there are additional requirements such as a medical examination or proof of insurance.

The A2 is a popular choice for riders who want to upgrade from the CBT, but aren't yet ready to get a full A licence. It permits the rider to use kup prawo jazdy kat a bike with a capacity of cylinders up to 125 cc and power up to 11 Kilowatts. You can use motorways and carry passengers. You don't need to display your learner plate in front or back. You can also use it to work as an motorcycle courier, and the licence is valid from the age of 18.

Direct entry and indirect entry are two options to obtain an A2 license. Direct entry is the most efficient method to obtain your A2 license, but it requires more theory lessons than indirect entry. The theory classes consist of two courses: a basic and an additional course which includes the specific requirements for the category A2 licence. You must complete 12 90-minute lessons for the basic course and four 90-minute classes for the additive course.

The indirect entry is a slower, but more convenient method to get your A2 license. Indirect entry requires you to complete a set of training courses and pass a test. You can pick from a wide range of driving schools to find one that fits your budget and timetable. The cost of training varies, but can be up to PS1,200 for a 5-day course.

If you pass the practical test, you are able to apply to Traficom e-Service to obtain an A2 category licence or visit the office of the service provider Ajovarma. You can apply for a Category A2 driving license without having to take the theory or handling test. However you must have a category A1 licence for at least two consecutive years.

The A1 driving license allows you to drive motorcycles whose cylinder volume doesn't exceed the 125 cubic centimeters limit and whose power doesn't exceed 11 kilowatts. This license is accessible to people who are aged 16.

Before they can get an A1 licence, applicants must pass two tests. The first is the theory test which has 25 questions. You have to answer them in under eight minutes.

How do you get an A1 driver's license

The A1 license is a great method to begin riding motorcycles or motor scooters. This license allows drivers to drive vehicles with up to 125cc engine power. It can be obtained by passing the CBT. The A1 licence can also be used to upgrade to higher categories and eventually to the full motorcycle license.

To get a driver's licence A1 You must take an instruction course at an approved driving school or an ongoing motorcycle training center. The course will comprise a theory component that will prepare you to take the Category A1 Driver's License test. The theory test comprises 50 questions, and you have to score at minimum 41 points to pass. You can take the test at an official centre or use an online practice test to prepare.

In addition to the theoretical driving training, you will also need practical training. The actual training will differ dependent on the vehicle you want to drive. In general, it should take at least 12 90-minute sessions. This training will familiarise you with the basics of the materials as well as the additive which will include the necessary requirements for the category of vehicle.

The A1 license is a popular choice for those who just completed an CBT course. It provides an easier and safer transition to motorcycling compared to a full motorcycle license. It also has lower insurance costs for motorcycles than a CBT licence. But, it's not a licence that should be taken lightly - if you're interested in riding larger bikes, you will need to upgrade to an A2 or full motorcycle licence after having the A1 licence for 2 years.

The A1 license is a popular choice for those who just completed an CBT course. It provides an easier and safer transition to motorcycling compared to a full motorcycle license. It also has lower insurance costs for motorcycles than a CBT licence. But, it's not a licence that should be taken lightly - if you're interested in riding larger bikes, you will need to upgrade to an A2 or full motorcycle licence after having the A1 licence for 2 years.To be eligible for an A1 driver's license, you must possess an active driving license (category B or higher) and pass the CBT test, and have the certificate of successful completion of the compulsory basic training (CBT). You may also be required to show proof of identity, address, and proof of parent/guardian residence. You will have to pay a fee of PS25. You can apply online, or by visiting your local driving authority or DVSA regional office.

What is the A1 driving license?

A1 is a type of driving license that permits you to drive a motorbike or moped. This is the initial step to getting a full motorcycle license and can be obtained at a young age of 16 years old. To obtain this license you have to pass the theory and the practical test at a certified driving school. After passing the test, an A1 license will be issued.

The A1 category allows you to drive a motorcycle with a maximum engine capacity of 150 cc and a maximum power of 11 kW. It also permits you to drive a two or Kup prawo jazdy b online three-wheeled moped. You will have to pass additional tests if you are planning to drive these kinds of vehicles. If you are an adult and want to drive a motorbike with more than 11 kW, then you need to pass a different test in order to obtain an A2 licence.

If you are an adult and already have a Category A1 license you can upgrade it to a Category A driving license after a period of two years. This can be done by taking a test at the Driving Schools Association. To qualify for this exam you must have completed a total of 12 lessons lasting 90 minutes each and pass the theory exam.

You can find the Driving Schools Association's contact details in the directory on our website. We'll be happy to help you select a course that fits your schedule. We recommend that you start with our base package. This package lets you take 12 90-minute theory classes and 1 practical lesson.

In the course you will be taught the fundamentals of road traffic and Kup prawo Jazdy A1 how to operate your vehicle. You will also learn how to determine your route and comprehend the rules. You will be guided by the driving instructor throughout the process. Although you can practice on your o ne but it is advised to follow the training closely to prepare for the practical and theory tests.

The current driving license is a laminated card that feels and looks similar to the European driving permit. It displays the name of the holder (in Latin and Cyrillic script), address, emergency contact blood group, fingerprint impression and photograph. The reverse side contains an alphabetical list of categories. Certain older licenses, such as the credit card and book style are still in use. However they are becoming increasingly rare.

What are the requirements for an A1 license?

There are a number of steps you need to follow if you want to obtain an A1 motorbike license. This includes the completion of a driving school course and passing the theory exam. After completing this training, you'll be able begin learning the fundamentals of driving and traffic rules. After that, kup prawo Jazdy a1 online you'll need to practice with your family and acquaintances until you are prepared to take the test. Once you pass the test, you will be able to begin riding your motorcycle.

The A1 category is a restricted licence that allows you to drive motorcycles or mopeds with an engine size of up to 125cc and an output of no more than 11kW. The A1 category also includes tricycles with two wheels and power/weight ratios of up to 0.1kW/kg. This licence is ideal for those looking to get experience in the world of motorbikes before taking the full A2 or a driving licence.

After two years, it's possible to upgrade your A1 license to full A, but you will need to take the theory and practical tests again. This process can be costly and frustrating, especially for riders who are young. This can be seen as a waste for people who use their bikes only to travel to work or transport passengers over short distances.

There are many ways to cut down on the cost of getting an A1 licence. One option is to go to a driving school that offers CBT training for free or at a discounted price. Another option is to finish the training with a private instructor, or an continuing ride centre.

Presently in the present, an A1 driving license is valid for 15 years. It has a numberplate as well as basic information such as the driver's name, father's name, date-of-birth, address, authorized vehicles, emergency contact information and blood group. It also includes magnet strips, but its viability is not yet tested.

How do you get an A2 driver's license?

To obtain a driver's license to obtain a driver's license, you must sign up for a driving school and successfully pass both physical and written examinations. The driving test is comprised of 50 multiple-choice questions. It's not too difficult, but it is recommended to be prepared prior to the test. You can also find online practice tests to aid you in preparing for the exam. The physical exam includes an eye-sight test, as well as a listening test. In some countries there are additional requirements such as a medical examination or proof of insurance.

To obtain a driver's license to obtain a driver's license, you must sign up for a driving school and successfully pass both physical and written examinations. The driving test is comprised of 50 multiple-choice questions. It's not too difficult, but it is recommended to be prepared prior to the test. You can also find online practice tests to aid you in preparing for the exam. The physical exam includes an eye-sight test, as well as a listening test. In some countries there are additional requirements such as a medical examination or proof of insurance.The A2 is a popular choice for riders who want to upgrade from the CBT, but aren't yet ready to get a full A licence. It permits the rider to use kup prawo jazdy kat a bike with a capacity of cylinders up to 125 cc and power up to 11 Kilowatts. You can use motorways and carry passengers. You don't need to display your learner plate in front or back. You can also use it to work as an motorcycle courier, and the licence is valid from the age of 18.

Direct entry and indirect entry are two options to obtain an A2 license. Direct entry is the most efficient method to obtain your A2 license, but it requires more theory lessons than indirect entry. The theory classes consist of two courses: a basic and an additional course which includes the specific requirements for the category A2 licence. You must complete 12 90-minute lessons for the basic course and four 90-minute classes for the additive course.

The indirect entry is a slower, but more convenient method to get your A2 license. Indirect entry requires you to complete a set of training courses and pass a test. You can pick from a wide range of driving schools to find one that fits your budget and timetable. The cost of training varies, but can be up to PS1,200 for a 5-day course.

If you pass the practical test, you are able to apply to Traficom e-Service to obtain an A2 category licence or visit the office of the service provider Ajovarma. You can apply for a Category A2 driving license without having to take the theory or handling test. However you must have a category A1 licence for at least two consecutive years.